Consequences of Inheriting an IRA

A recent study projected that around $72 trillion in assets would be transferred to heirs by 2045 (Cerulli Associates, 2022). In 2023, the federal estate gift tax exclusion is $12.92 million for an individual and $25.84 million for a couple (Internal Revenue Service, 2022b). In this blog post, I am going to assume that the assets being passed along are under that limit.

What happens if you inherit an IRA? The rules for inherited IRA accounts have undergone some big changes over the last several years with the passage of the Setting Every Community Up for Retirement Enhancement (SECURE) Act and the SECURE Act 2.0. Unless you are a designated beneficiary, the inherited IRA needs to be liquidated by the end of the 10th year following the death of the decedent (Internal Revenue Service, 2022a). In some cases, there are annual required distributions. It is important to understand that the distribution of a traditional IRA is usually taxable as ordinary income. Large distributions can have a big impact on your situation. Let’s look at a couple of different scenarios.

The Situation

James and Linda are 64 years old. Linda is an only child, and her 85-year-old mother, Edna, recently died and left her a $300,000 IRA. James and Linda currently have $200,000 of reportable income from their wages.

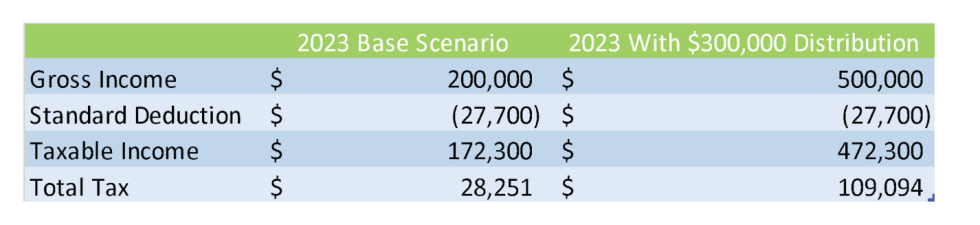

Lump-Sum Distribution

James and Linda decide that they want to liquidate the account. They are fine with paying taxes because they are not counting on the money and would like to do some home renovations. They fill out the forms to move the account and take a lump-sum distribution. The $300,000 distribution costs them an additional $80,573 in federal taxes. They pay the taxes from the proceeds of the distribution, use the money for the renovations, and move on with their lives.

In the fall, at age 65, James and Linda decide to retire and file for Medicare. They get an income-related monthly adjusted amount (IRMAA) determination in the mail. The letter tells them that their cost for Medicare is $597 each per month (this is the 2023 cost) due to their income in the year of the distribution. They had no idea they would have to pay this additional cost of $14,328.

For more about IRMAA, read this article:

https://strategicpathretirement.com/who-is-irmaa-and-why-is-she-taking-my-social-security-money/

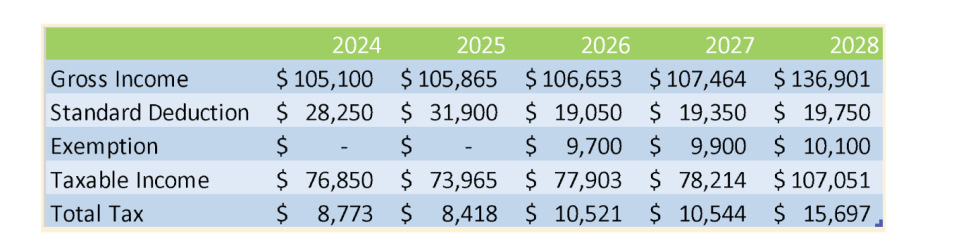

Retire and Liquidate Over 5 Years

In a different scenario, James and Linda decide to retire the year after they received the inheritance and take distributions over 5 years. They will complete their home renovations over several years. The distribution plus their combined Social Security payments of $60,000 per year cover their expenses.

This calculation assumes that the inherited IRA grows by 3% and they take $60,000 per year for four years and distribute the remaining funds in the 5th year. It also assumes that Social Security grows at 3% and the Tax Cuts and Jobs Act expires at the end of 2025.

The projected federal income tax liability under this scenario is $53,953. That is $26,620 lower than in the previous scenario. In addition to the lower income tax, James and Linda avoided the projected IRMAA surcharge of $14,328, and they made an additional $19,104 in interest on the inherited IRA.

The total advantage gained by taking it out over 5 years is $60,052.

Conclusion

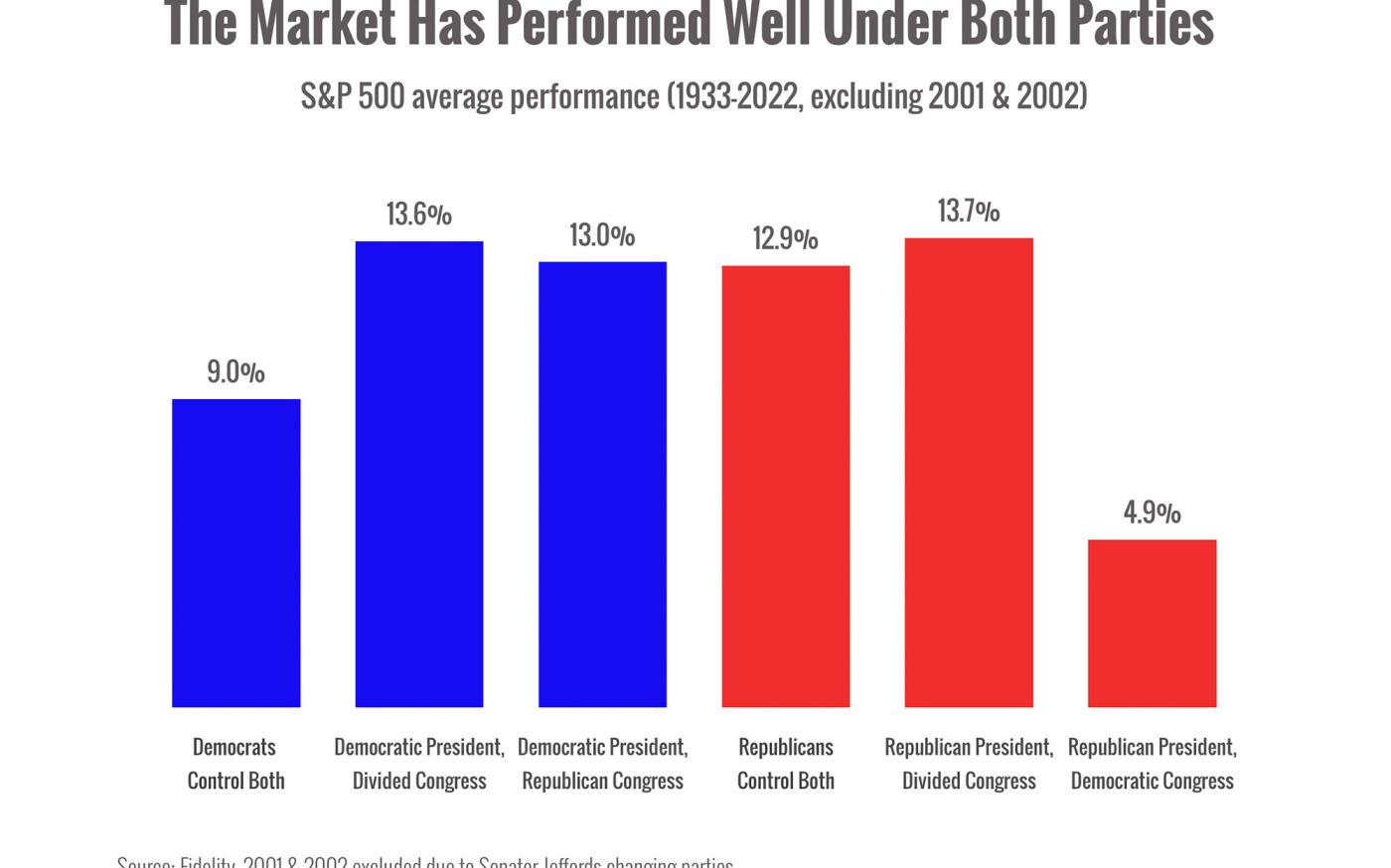

I used very different scenarios to show the difference in distribution approaches. This scenario could play out in countless other ways. Don’t underestimate the importance of working with a professional who can project the potential benefits or consequences of different scenarios so that you can make an informed decision.

References

Cerulli Associates. (2022, January 20). Cerulli anticipates $84 trillion in wealth transfers through 2045 [Press release]. https://www.cerulli.com/press-releases/cerulli-anticipates-84-trillion-in-wealth-transfers-through-2045

Internal Revenue Service. (2022a). Publications 590-B (2021), distributions from individual retirement arrangements (IRAs) (Publication No. 590-B). https://www.irs.gov/publications/p590b

Internal Revenue Service. (2022b). What’s new—Estate and gift tax. https://www.irs.gov/businesses/small-businesses-self-employed/whats-new-estate-and-gift-tax

Author: Brian Hill, CFP®, Managing Partner/Advisor

Note: Information is accurate at the time of publication, March 2023.

Advisory services offered through Commonwealth Financial Network®, Member FINRA/SIPC, a Registered Investment Adviser. Fixed insurance products and services offered through CES Insurance Agency or Strategic Path Wealth Management.

Commonwealth Financial Network® and Strategic Path Retirement do not provide legal or tax advice. You should consult a legal or tax professional regarding your individual situation.