Retirement is hard. Knowledge is the first step.

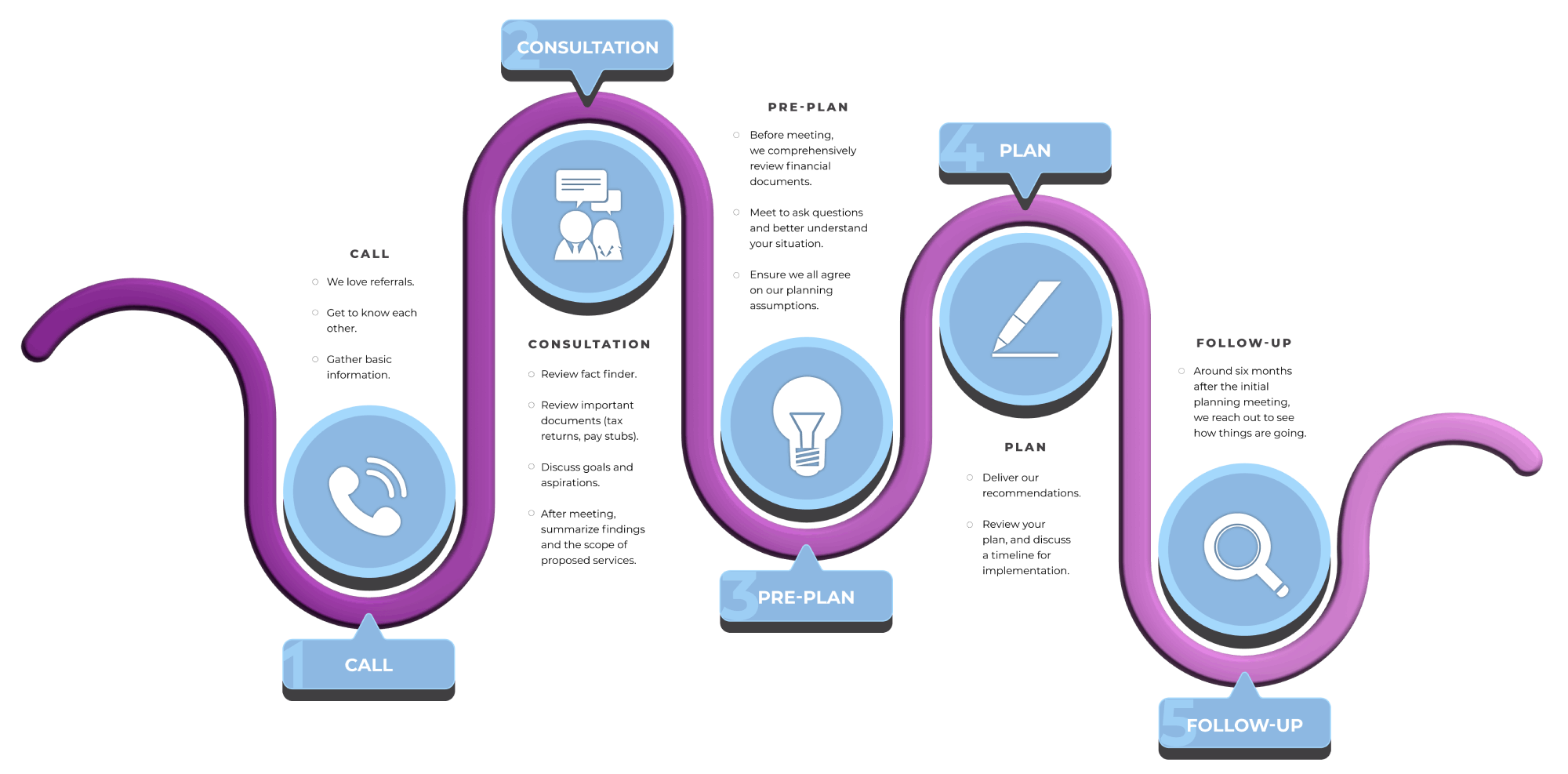

YOUR JOURNEY WITH STRATEGIC PATH

Meet Self-Starter, Henry

While HENRY is an acronym for high earner, not rich yet, Henry is a client that resembles a large part of our client roster. Henry and his wife have three kids and a dog. They spend Saturday at the baseball and softball fields during the summer, and in a gym for basketball and wrestling in the winter. The weeks are busy, and the weekends are more active. They have a significant income, but need a plan for what to do with it. They want to spend time with their family instead of always managing their finances.

- Situation

- Need

- Results

If you have a decent income and wonder where it all goes, Strategic Path can help you get the answers you need to work toward a better retirement.

Some financial advisors don’t like working with individuals who haven’t acquired enough money to meet their asset minimums. We can work with you on an hourly basis or help you create a comprehensive plan that fits your needs. We charge only for our time and don’t require commissions from product sales for compensation; therefore, we are able to make recommendations that fit your unique financial situation.

We review your financial situation from top to bottom, including your income and your expenses, your assets and liabilities, and your insurance. We work with you to figure out how much you will need for retirement and if what you are doing now will get you to the finish line in the time frame that you envision. We review your plans for your kids’ college tuition, and make sure that your money and goals are aligned. We help you manage cash flow if your paycheck fluctuates month to month. We assist you in charting a path to your goals.

Meet Business Owner, Sam

Sam values quality over quantity, loves the great outdoors, prefers craft beers, and is a second-generation owner of his family business which employs about 200 terrific people.

We work with business owners from many different industries. How can we help?

- Situation

- Need

- Results

Perhaps your company has great cash flow, but you aren’t sure where it all goes. Perhaps you have a successful business, but your personal finances are a mess. Perhaps you lack structure on how you take income from your company. Perhaps you struggle to align your business income and your personal spending and savings goals. Perhaps you pay too much in taxes. Perhaps you have trouble figuring out when or if you can retire. Perhaps you aren’t saving for retirement.

You want to be an effective leader whom your employees trust and through whom they can see their path to financial security. You need a trusted advisor to help achieve your business’s vision and manage your personal finances, someone who can help create a better financial plan for your business and hold you accountable.

We help you find a balance between your business and personal finances. We work with your tax and legal team to help you create a path to retirement. We guide your team in creating an order of operations for your cash flow. We help maximize personal tax-advantaged savings strategies, as well as in your business. Strategic Path also offers corporate retirement plans. So, when you are ready, our team will take a personal approach and get to know your employees as part of the planning process. Our goal is to listen to your needs and advise before developing a plan.

Meet Soon-to-Be Retiree, Lucinda

Ahhhhh, yes retirement is in her near future. She loves her six-year old grandson. Lucinda and her husband look after their parents, love going to T-ball games, discover new restaurants and when they need down-time they are gardening. Lucinda’s career has already spanned 25 years!

- Situation

- Need

- Results

Always busy at home and work, perhaps you’ve never had the time to sit with a retirement planner. Do you wonder if you can put a plan in motion or if it is too late? Strategic Path can help get the answers you need to work toward an enjoyable retirement.

Lucinda is now looking for guidance to make sure she is on the right path for all her retirement financial goals.

Your eyes are set on retirement, yet it seems so far away. Our advisors get so many questions about retirement: When is the right time to start thinking about retirement? How much do I need for retirement? When do I collect social security? Do I have the right investments? How will I pay for health care? Will I have enough to continue my tithes and donations to charity? Can I afford to retire while helping my aging parents? Will I outlive my money? How do taxes work once I retire?

We help you calculate how much you will need to retire. We test that amount against different situations to make sure that you don’t have to return to work after retiring. We review your retirement cash flow and monitor how much you pay in taxes. We ensure we budget for life events, your children, and your parents. We discuss and plan for health-care costs in retirement.

These are case studies and are for illustrative purposes only. Actual performance and results will vary. These case studies do not represent actual clients but a hypothetical composite of various client experiences and issues.

Have Questions?

Learn more about our custom retirement planning topics in our glossary.

Ready for More?

Take the First Step Toward Early Retirement

Let’s gather some basic information about you. It’s simple, and there’s no obligation after your complimentary consultation.

How Can We Help You?

- Retirement planning

- Investment strategy

- Tax Planning

- Social Security optimization

- Investment protection

- Estate planning analysis

- Insurance coverage review

- High net worth investing

- In-retirement income maximization