Is inflation rising again?

As we kick off 2024, the latest data is raising some concerns about inflation.

Let’s dive into some data and take a look.

Inflation is still one of the biggest risk factors we’re watching this year. Here’s why.

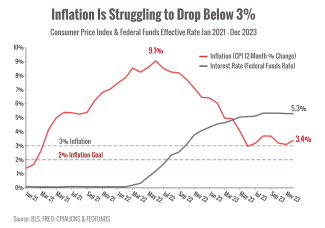

While inflation is still well below its 2022 peak, the data shows that the fight toward 2% still has pretty far to go.

Annual inflation has stubbornly remained above 3%, and the December report shows another tick upward.1

While market watchers are hoping the Federal Reserve will cut interest rates soon, policymakers warn easing off too soon could erode progress and cause inflation to “seesaw.”2

It’s likely that the Fed will be cautious and decide to wait for more data before lowering rates.

However, the longer they keep interest rates high, the more they risk hurting economic growth.

It's a tough act to balance and we expect the uncertainty to stoke market volatility.

The December jobs report looked strong, but may be masking some pain.

The latest employment report showed that the economy added a respectable 216,000 jobs. But many of those new jobs were in the public sector and other industries that aren’t sensitive to the economy.3

Small businesses are lowering their hiring expectations, and manufacturers and service companies cut jobs in December.

Another point of concern: jobs numbers have been revised downward in 11 of the last 12 months, suggesting that the economy may be shifting gears and slowing down.

Geopolitical issues are also adding clouds on the horizon.

Ugly wars in Ukraine and Israel are still burning, and attacks on shipping in the Red Sea are adding fresh concerns about global stability.4

In addition to the cost in human lives and misery, geopolitical uncertainty may weigh on economic growth and inflation.

On a positive note, December retail sales increased more than expected.5

Americans shopped more than anticipated in both November and December, showing that consumers may be in better shape than many economists feared.

While some analysts are already celebrating a “soft landing” and an end to recession worries, we’re still keeping our seatbelts buckled.

The economy is still growing, but we’re expecting to see bumps and potholes on the winding road to “normal” inflation levels.

While recession risks have lowered, we're still watching carefully.

Questions? Concerns about market moves? Give our office a call and we'll set up a time to talk.

Sources

2. https://finance.yahoo.com/news/1-feds-bostic-warns-us-122602986.html

3. https://www.usatoday.com/story/money/2024/01/16/recession-signs-soft-landing-forecasts/72209418007/

4. https://www.reuters.com/business/red-sea-attack-fears-disrupt-global-trade-patterns-2024-01-16/

5. https://finance.yahoo.com/news/december-retail-sales-surprise-to-the-upside-133212009.html

Chart sources: https://fred.stlouisfed.org/series/CPIAUCNS#0, https://fred.stlouisfed.org/series/FEDFUNDS

Risk Disclosure: Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Past performance does not guarantee future results.

This material is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. The content is developed from sources believed to be providing accurate information; no warranty, expressed or implied, is made regarding accuracy, adequacy, completeness, legality, reliability, or usefulness of any information. Consult your financial professional before making any investment decision. For illustrative use only.

This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific situation with a qualified tax professional.