Should I Pay Off My House When I Retire?

We get a lot of questions. Sometimes the answer is simple, and sometimes, the answer is more complicated. Most of the time, the answer is a resounding no. This one is usually simple: Should I pay off my house when I retire? Let’s walk through a few scenarios so you can get a feel for why.

Some assumptions about a common scenario so that we can have a clear understanding of the pros and cons of the payoff:

- Mr. and Mrs. Homeowner have a home worth $500,000.

- They are 15 years into a 30-year mortgage of $400,000.

- This timeline assumes that the mortgage was taken out in 2007

- The average rate for a mortgage in 2007 was 6.34%

- We are going to assume that they did not refinance

- Their principal and interest payments are $2,486.33/month (this does not include property tax and homeowner insurance).

These assumptions lead to some data points that help to add some color to our conversation. By 2022:

- They have paid $111,674 in principal

- They have paid $335,864 in interest

- The remaining principal balance is $288,324

- The remaining interest will be $159,214

As a mortgage gets closer to the final payment date, a larger amount of each payment goes towards the principal, and a smaller amount goes towards interest. That means that as you get closer to the end of the loan, you are paying less interest per payment.

- In the first 15 years, the mortgage payments were $447,539

- 75% of those payments were interest

- 25% of the payments were principal

- The second 15 years of the mortgage payments will be the same $447,539

- 35% of those payments will be interest

- 65% of those payments will be principal

The above calculations help us conclude that paying off a mortgage at the end of the term will save some interest, but the bulk of the payoff will save on future principal payments. There may be better places for one’s money in retirement than to pay down the principal on a loan.

This is if we just look at the question through the lens of principal vs interest. What if we take it further and examine some tax consequences?

What happens if the loan payoff comes from a retirement account?

Here are some additional assumptions:

- Mr. and Mrs. Homeowner are 65, and they are married.

- They made $70,000 from their job in the year of retirement and are not collecting Social Security.

- They will not take any additional income in the year of retirement; they will use their savings to get to the first full year of retirement.

- They have sufficient balances in their retirement accounts to pay off the mortgage without causing a negative impact on their future distributions.

Scenario 1:

They take the funds to pay off the mortgage from a retirement account.

- They need $289,000 to pay off the mortgage

- To get the necessary amount, they would need to withdraw enough money to pay off the mortgage and cover the additional taxes. They would need to withdraw approximately $380,000 and withhold $91,000 for federal taxes to get the $289,000 that they need to pay off the mortgage.

- The additional distribution from their retirement accounts will trigger additional Medicare taxes of $445.60 each above the base amount (based on 2022 numbers). This is an additional $10,694/year that they will pay above their normal Medicare cost. They may be able to file for a reduction in premium due to no longer having wages, but it isn’t guaranteed to be accepted by the IRS.

Scenario 2:

They take annual distributions to pay for the mortgage payments throughout retirement

We will assume that Mr. and Mrs. Homeowner have Social Security payments totaling $35,000. In addition to the Social Security, they will take withdrawals from their retirement account to make the mortgage payments.

- The mortgage payment is $2,486.33/month

- They will have to take $2,587/month and withhold $100 for federal taxes to cover their annual tax liability.

- This also covers the taxes from their Social Security income

Conclusion:

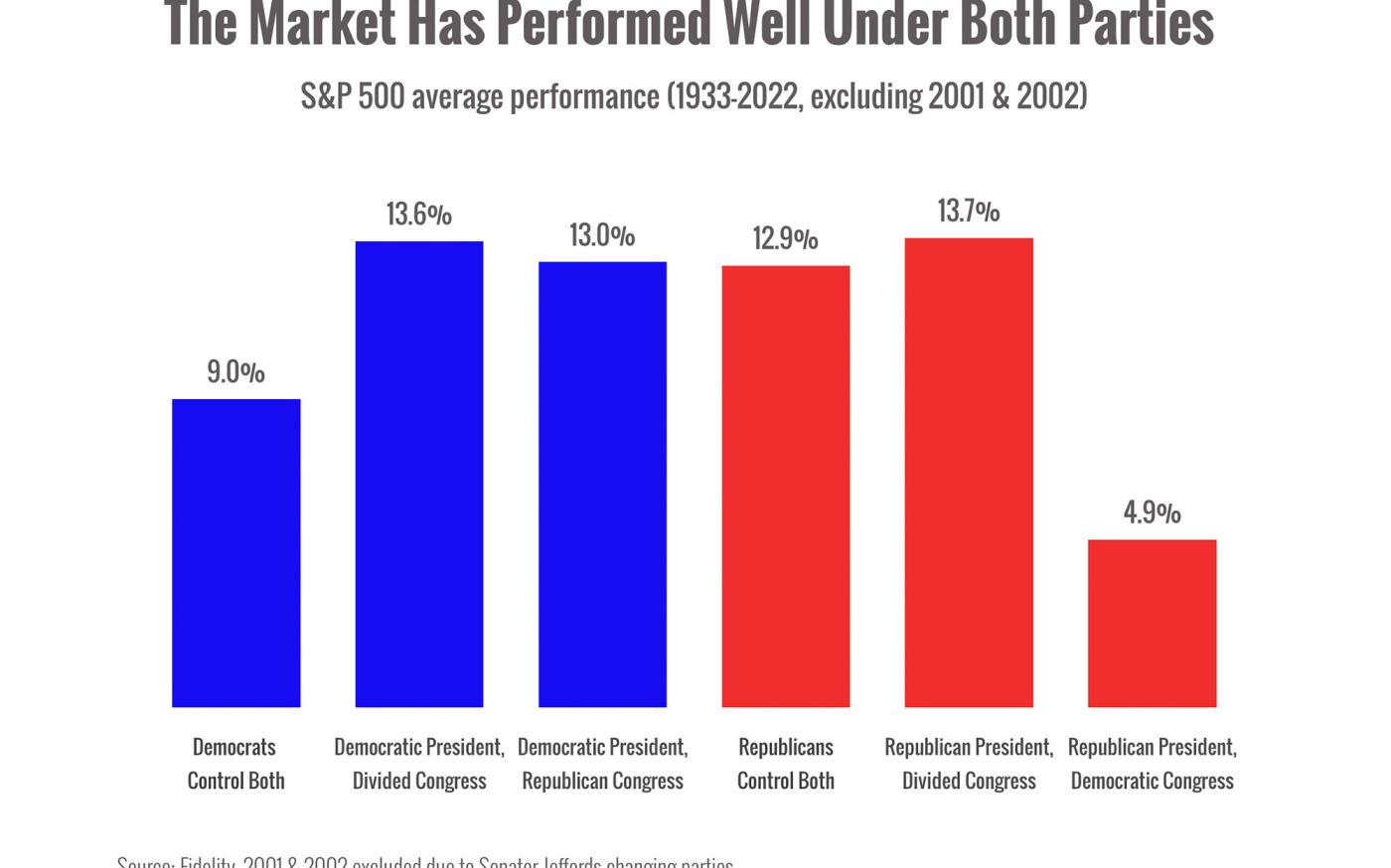

The above examples are extreme. If we were modeling this for a client, we would want to include capital gains, dividends, and interest. There would also be additional withdrawals for living expenses. The point of the above exercise is to show the unintended consequences of a large distribution from a retirement account to pay off a mortgage. The client would have saved a large amount of interest (approximately $159,214) by paying the mortgage off early, but the payoff would have caused approximately $101,694 in taxes and Medicare costs. While the interest saved is higher than the taxes, the scenario fails to consider the growth of the investment account that the money was taken from. If the $380,000 were to average a return of 6% over the 15-year repayment period, the final balance in the account would be $209,580. When this is taken into consideration, it makes the economic benefit of the payoff over time a better choice than paying the mortgage off in a lump sum.

Author: Brian Hill, CFP®, Managing Partner/Advisor

Note: information is accurate at the time of publication, October 2022.