Why Do I Care About Interest Rates?

I don’t know if you have been paying attention, but housing prices have fallen for the first time since 2012. Earlier this year, the Federal Reserve started raising the federal fund’s target rate—the rate banks borrow from one another. Why do you care about the rate banks charge one another? Because it impacts consumers in several ways, one of which is the rates that banks lend money for mortgages.

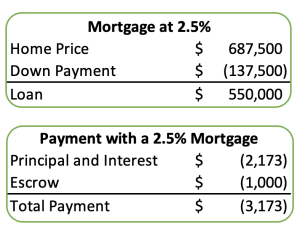

A MORTGAGE IN EARLY 2021

Let’s take a journey back to early 2021. Interest rates were low, and so was housing inventory. Let’s pretend that you were going to buy a house. You went to a lender and got preapproved for a mortgage of $687,500. You went out with your realtor and found the perfect house. The cost was slightly below your budget, but you bought it for the full amount because you had to offer above the asking price (a common situation back in early 2021). You needed 20% of the purchase price for your down payment, so you gathered the money from the sale of your previous home and your savings, as well as the sale of some appreciated stock, to come up with $137,500. (In some situations, you may not have wanted to put 20% down, but we will save that discussion for another day.) You took out a mortgage for $550,000 at 2.5%. The principal and interest portion of your mortgage payment totals $2,173 per month, and the escrow amount of your payment is $1,000 per month. Your total payment is $3,173.

A MORTGAGE IN LATE 2022

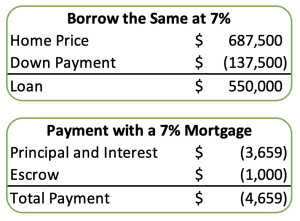

Let’s pretend that things had gone differently in 2021. What if you hadn’t found a house? What if you had been outbid? What if you had decided to wait for the housing market to cool down?

In this scenario, you are shopping for a house in October 2022. Times have changed, and rates are now 7%. That’s 4.5% higher than it was 18 months ago. If you use the same amount for your down payment ($137,500), and borrow the same amount of money ($550,000), your payment increases from $3,173 to $4,659! This is a difference of $1,486 per month. Can you afford a 47% increase in your payment? If you landed a new job or got a big raise, it might have worked. If you didn’t, you may not even qualify for the higher payment.

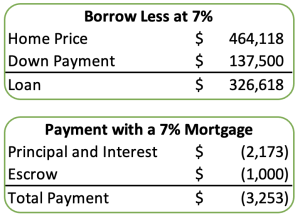

If you didn’t get a big raise or enter a financial windfall, you can borrow less. If you decide to keep your payment the same, you can buy a house for $468,118 with a mortgage of $326,618. That’s $223,382 less house than 18 months ago for the same payment!

CONCLUSION

By now you are either wishing you had bought a house in 2021 or that you hadn’t read this article. If you bought a house in 2021, you are probably feeling pretty good about yourself (even if you did end up paying more than the asking price). The goal of this article is to show you how changes in circumstances that are out of your control can dramatically impact your finances.

This is why we focus on financial goals in each of our planning conversations with our clients. We discuss goals for the next 12 months, the next 1–5 years, and the next 5+ years. This way, we have a plan for when to buy a house and how to fund the payments. If your meeting with your financial planner is an hour-long breakdown of investment graphs and economic forecasts, reach out to schedule a complimentary consultation to discuss your goals and see if we are a good fit for each other.

Author: Brian Hill, CFP®, Managing Partner/Advisor

Note: information is accurate at the time of publication, January 2023.

Reference

Gopal, P. (2022, September 27). US housing prices fall for the first time since 2012. Bloomberg. https://www.bloomberg.com/news/articles/2022-09-27/us-home-price-growth-slowed-in-july-as-housing-market-cools